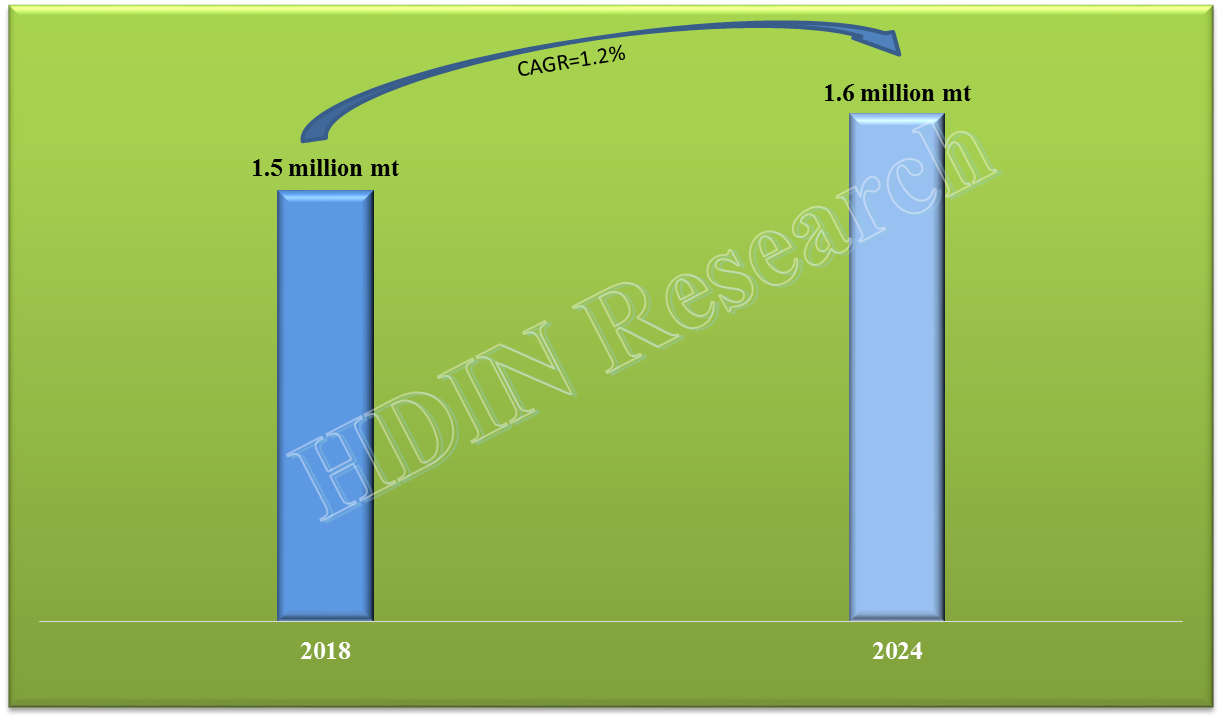

Hexamethylenediamine Market Size will reach to 1.6 million mt in 2024

Hexamethylenediamine is a colorless crystalline solid at room temperature. Hexamethylenediamine and adipic acid are the monomer to produce nylon 66. Producing 1 mt nylon 66 usually need 0.65 mt adipic acid and 0.52 mt hexamethylenediamine. Hexamethylenediamine also can be used in hexamethylene diisocyanate, adhesive & coating, paper, water treatment & detergency.

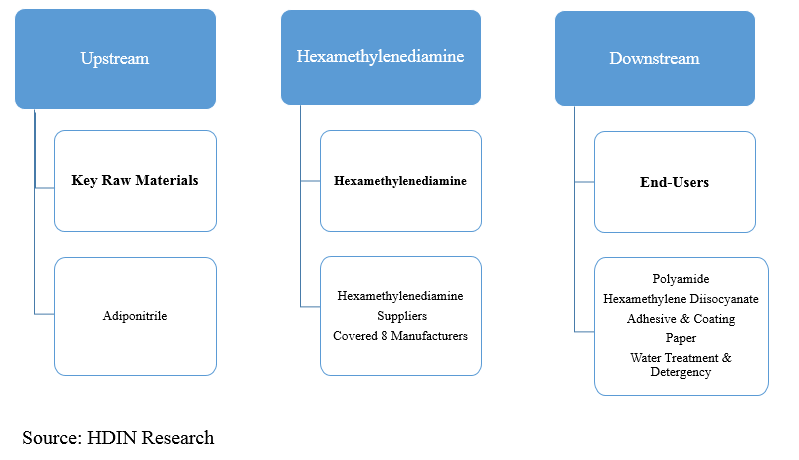

Adiponitrile is the key raw material of hexamethylenediamine. This report covers the industrial chain of Hexamethylenediamine. Following are the industrial chain structure chart:

Hexamethylenediamine market is dominated by Invista, Ascend and BASF (including Solvay) and the CR3 of production capacity exceeds 70%. Other players include Radici Group, Asahi Kasei, Toray, Henan Shenma and Anshan Guorui. US is the largest production and export country of hexamethylenediamine. US exporting market share in 2019 reach to 76%. Germany is the largest consumption and import country of hexamethylenediamine. Germany importing market share in 2019 reach to 35%.

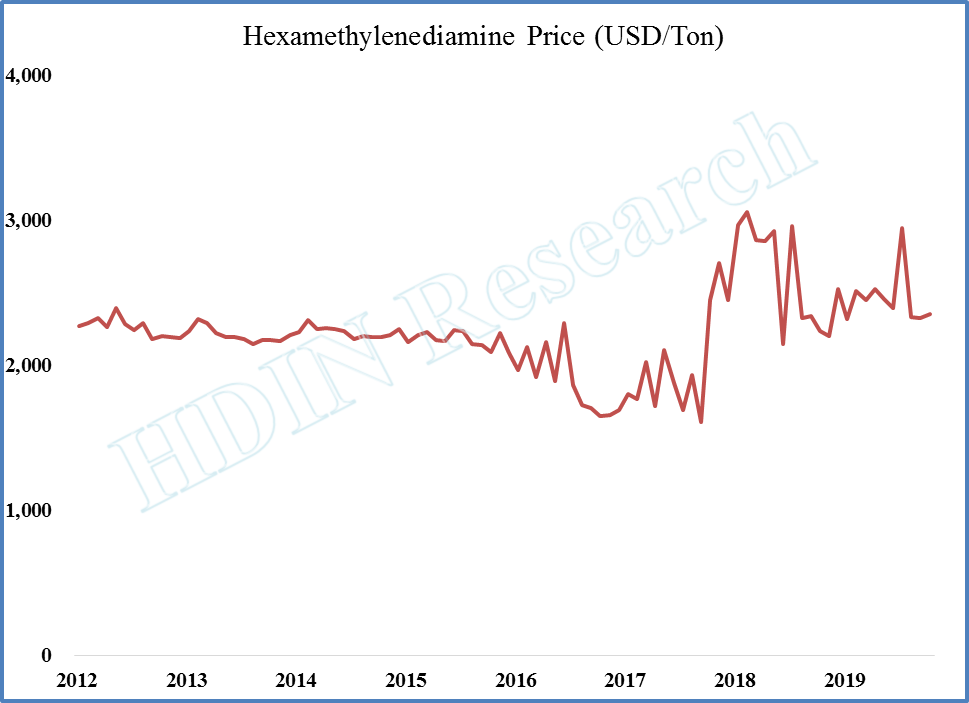

The price of hexamethylenediamine is deeply affected by the production situation of Invista, Ascend and BASF. The price grow very rapidly in 2018 due to force majeure of Ascend and BASF on Jan., 2018. On Feb., 2019, the price jump again due to force majeure of Solvay France adiponitrile factory. Following are the price trend of hexamethylenediamine from 2012 to Q3, 2019.

Global Hexamethylenediamine market size was estimated at 1.5 million mt in 2018 and the market size will reach 1.6 million mt in 2024, with a CAGR of 1.2% due to weakly demand of nylon 66.

Related News:

Adiponitrile Market Size will reach to 1.5 million mt in 2024